Circularity as a Lucrative Investment Opportunity

In recent years, a significant transformation has been underway in the world of finance, with Environmental, Social, and Governance (ESG) considerations taking center stage. This shift is not merely ideological but stems from a growing recognition among financial decision-makers that sustainable practices are not only ethically sound but also financially lucrative. As corporations face mounting pressure to address societal challenges, a parallel movement is unfolding, propelling the circular economy into the spotlight as a lucrative investment opportunity. This change can be attributed to various factors.

1. In a shifting landscape, financial decision-makers with aspirations beyond mere monetary gains are demanding tangible actions from corporations. The prevailing sentiment acknowledges that Environmental, Social, and Governance (ESG) considerations not only serve as risk indicators but also foster enduring expansion and cultivate novel avenues of value by supporting entities that are actively addressing the current social challenges. Insights from Opimas and the Global Sustainable Investment Alliance unveil a staggering surge in ESG investments, exceeding $40 trillion in 2020 from a baseline of $23 trillion in 2016. Projections by Deutsche Bank underscore an imminent paradigm shift, suggesting that a substantial 95% of assets under management, equating to $130 trillion, will align with ESG principles by 20301.

2. Concurrently, governmental bodies, regulatory authorities, and central banks are realigning public expenditures and policy frameworks to facilitate the shift toward an all-encompassing, environmentally conscious circular economy. The configuration of investment opportunities is transforming, evolving beyond being a fad to manifest as a substantial and widespread movement1.

“Over the last 18 months, funds that focus on environmental-focused investments have outperformed almost all other forms of index, some people will call that a momentum investment. I would call that a sea change, I would call that a recognition that we have to move forward fast. Larry Fink, CEO, BlackRock 13 August 20211.

These factors have resulted in a substantial upswing in dedicated financing activities to offer investors a wider array of options to align their portfolios with sustainable and circular practices, leading to the emergence of different debt and equity instruments tailored to support circular economy initiatives.

Among these financial instruments are public equity funds (their number increasing from 2 in 2018 to 13 in 2021 including funds from the world’s largest investors BlackRock, BNP Paribas, Credit Suisse, and Goldman Sachs), corporate and sovereign bonds, venture capital, private equity (tenfold increase in the number of private market funds from 2016 to H1 2020), and private debt. Financial institutions have also actively participated in driving circular economy initiatives through bank lending, project finance, and insurance solutions2.

One example of the financial sector’s commitment to sustainable and circular practice is the exceptional growth in assets under management (AUM) in public equity funds centered around the circular economy. Between December 2019 and the first half of 2021, AUM skyrocketed from $0.3 billion to an astounding figure exceeding $9.5 billion at the end of November 2021, demonstrating a 28-fold in less than 2 years2.

Additionally, between December 2019 and December 2021, the issuance of corporate and sovereign bonds centered around the circular economy witnessed an impressive 5-fold increase. Over the past three years, a minimum of 40 such bonds were issued, highlighting the growing interest and commitment towards financing circular economy initiatives2.

Last, but not least, index providers are diversifying their offerings to encompass the circular economy domain, unveiling a host of new specialized products. Here are a few examples:

— Solactive has taken the lead by introducing an index with a focus on the sharing economy.

— Morgan Stanley Capital International (MSCI) has entered the scene with its index that highlights the circular economy and renewable energy.

— ECPI group has launched the Circular Economy Equity Leader Index, designed to capture companies excelling in various circular economy aspects3.

This remarkable financial mobilization highlights the confidence of stakeholders that the circular economy is not just an ethical choice but also an increasingly lucrative investment opportunity.

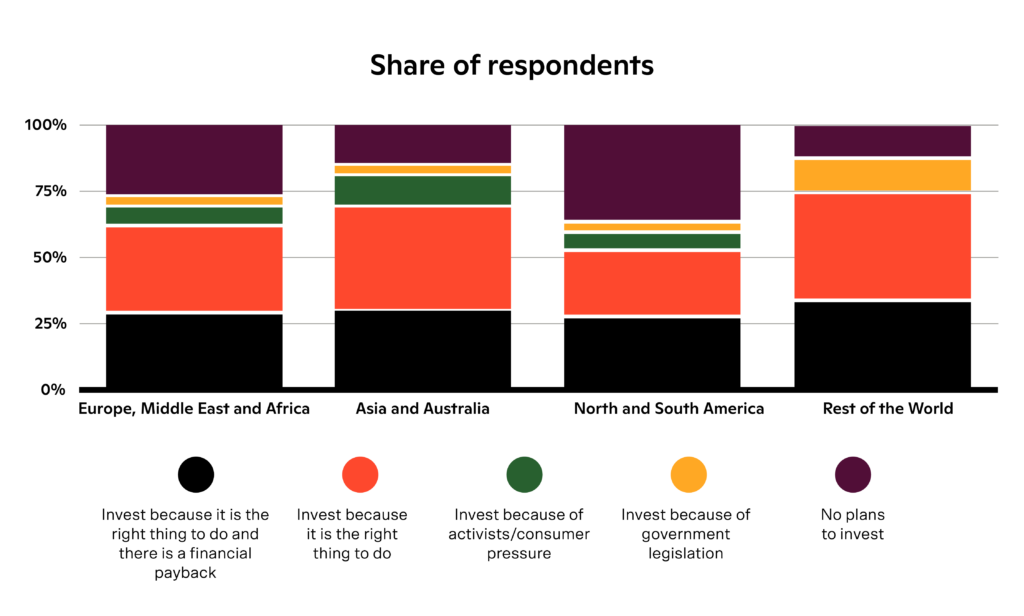

That confidence is also supported on the individual level. Naturally, many investors choose to invest in the circular economy because it is the right thing to do. However, it becomes obvious that increasingly, investors recognize the financial potential of such investments. Roughly one-third of investments in the circular economy in Europe, the Middle East, Africa, Asia, Australia, and North and South America are recognising the increasing returns4.

The rising confidence from financial institutions and individuals is not without support. A recent analysis by Bocconi University of 200+ European publicly listed companies supports the idea that circularity is the new winning strategy for investors looking to de-risk their investments and deliver superior risk-adjusted returns2.

The circular economy as a strategy to de-risk debt

In recent years, it has become increasingly clear that factors such as climate change, other climate-related crises, rising geopolitical tensions, and other societal challenges pose significant investment risks, and the financial sector is recognizing that. All actors in the financial system should work towards avoiding a climate-driven ‘Minsky moment’.

The recent analysis highlights that the more circular a company is the lower the risk of defaulting2. A 0.1 increase in Circularity Score (scoring developed by Bocconi University and Intesa Sanpaolo) is responsible for the reduction in the probability of default on debt by 8.63% (one-year timeline) and by 4.93% (five-year timeline)2.

The circular economy as a strategy for superior risk-adjusted returns

The same analysis concludes that the more circular a company is, the higher the risk-adjusted returns it generates on investment2.

Public equity funds with circular economy as a sole or partial investment focus on average performed 5.0 percentage points better than their Morningstar category benchmarks in the first half of 20202.

Potential drivers of these circular economy benefits include:

— a focus on design and business model innovation and diversification

— achieving greater resource decoupling

— anticipation of stricter regulation

— changing customer preferences

— resource scarcity

As the world grapples with pressing environmental and social challenges, the circular economy emerges not only as a solution but also as a lucrative investment opportunity. By embracing sustainable practices and innovative business models, investors can not only contribute to a more resilient and equitable future but also reap substantial financial rewards. In an era where the intersection of profitability and sustainability is increasingly recognized, the circular economy stands poised to redefine the landscape of finance for years to come.

Sources:

1 Mark Carney, Unlocking the Value of the Circular Economy, https://ellenmacarthurfoundation.org/articles/unlocking-the-value-of-the-circular-economy, August 2021.

2 Bocconi University, Ellen MacArthur Foundation, Intesa Sanpaolo (2021), The circular economy as a de-risking strategy and driver of superior risk-adjusted returns, http://www.ellenmacarthurfoundation.org/publications.

3 Mara Steinbrenner, Financing Circular Economy, https://neosfer.de/en/financing-circular-economy/, September 2022.

4 Martin Placek, Circular economy investment motives and decisions worldwide in 2019, by

region, https://www.statista.com/statistics/1182841/circular-economy-investment-decision-region/, April 2022.

The Circular Economy has emerged as a pivotal economic model, offering not only sustainability but also significant financial opportunities. With projections indicating exponential growth, understanding its profitability is crucial for businesses and policymakers alike.

Current State and Forecast

The worldwide revenue of circular economy transactions was estimated to total roughly $339 billion in 20221. This is forecasted to more than double by 2026, reaching a $712 billion market opportunity. Keep in mind that this estimation only takes into account the categories of secondhand, rental, and refurbished goods, leaving aside a large pool of major circular business models, such as recycling. Including those in the equation would likely increase the value of the economy significantly, considering the projected value of the global waste recycling services market size of $88 billion, which in turn registers a 4.79% annual growth (CAGR) for the period 2020-20302.

In a forward-looking perspective, delving into the future reveals the potential of the Circular Economy to contribute an extra $4.5 trillion to global economic output by 2030, a figure that could surge to a remarkable $25 trillion by 20503. Additionally, the projections by The World Economic Forum highlight the transformative impact of recycling, reuse, and remanufacturing, suggesting that by 2025, these practices could unleash annual untapped resource savings of $1 trillion. Looking even further ahead, this value is predicted to double, reaching an impressive $2 trillion per year by 20504.

McKinsey’s Projections

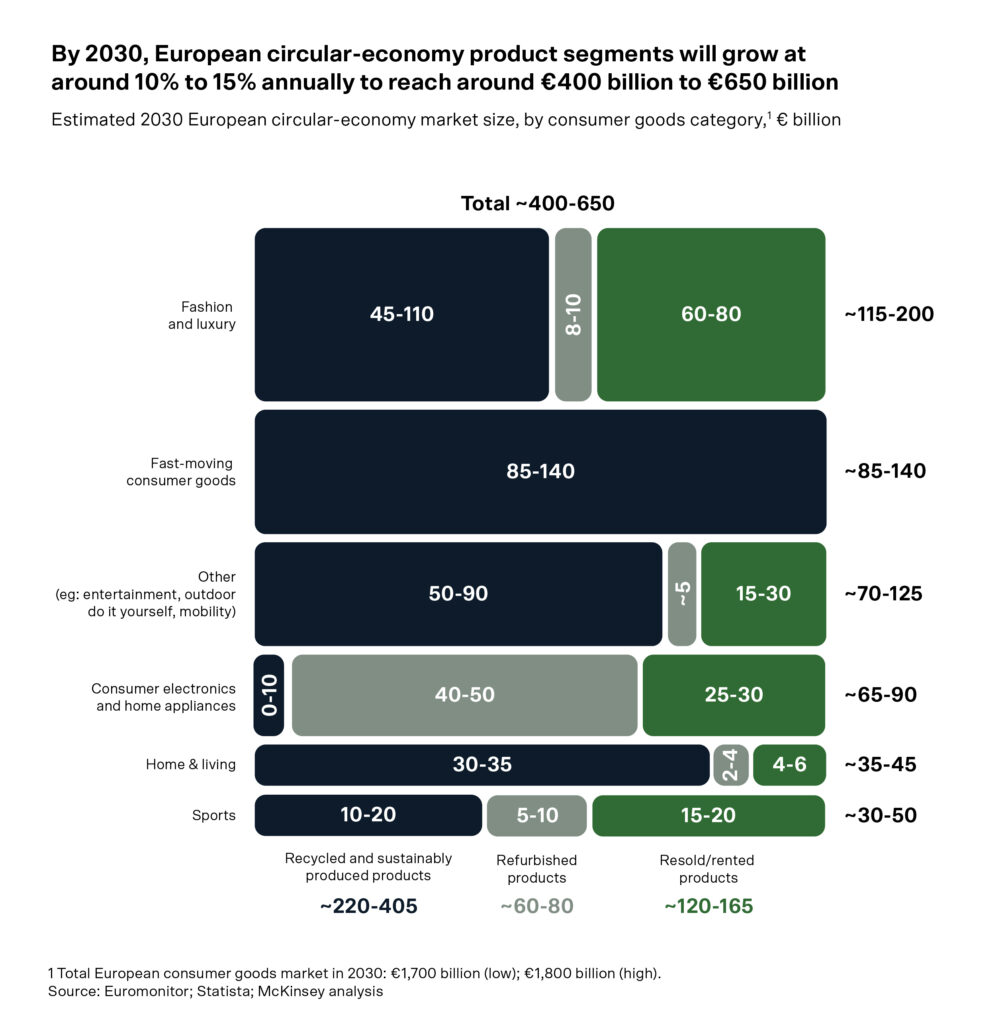

According to McKinsey’s projections, European consumer goods companies can achieve circular value pools exceeding €500 billion in annual revenues by 2030 through portfolio transformation, green business expansion, green premiums, and circular-focused operations. This significant shift will be propelled by changing consumer preferences, especially among younger generations who are using their purchasing power to express their values.

Zooming in on the added value per industry, McKinsey estimates that in FMCG, recycled and sustainably produced products are expected to see 15 to 25 percent annual growth (CAGR) until 2030, while recycling in fashion is expected to record 15 to 30 percent CAGR, generating €45 billion to €110 billion of annual value.

Part of the added value would be due to more efficient raw material usage. McKinsey reports that a circular economy would allow Europe, which is very resource-dependent, to grow resource productivity by up to 3% yearly. This transition is expected to generate a primary resource benefit of as much as €0.6 trillion annually by 2030 to the EU economy. Additionally, the forecast for non-resource and externality benefits is €1.2 trillion, bringing the annual total benefits to around €1.8 trillion.

This would translate into a GDP increase of as much as 7 percentage points relative to the current development scenario, with additional positive impacts on employment.

Drivers of Circular Economy

The reasons for the profitability of the Circular Economy are, among others, tax subsidies or preferential treatments from the government, a better competitive advantage, the reuse of waste into new products, and more efficient use of raw materials and energy consumption. Therefore, oftentimes, the benefits associated with circularity are greater than the involved costs5.

The profitability of the Circular Economy is multifaceted, encompassing tax incentives, competitive advantages, and resource efficiency. As benefits outweigh costs, embracing circularity presents not only sustainability but also financial gains for stakeholders.

Sources:

1 P. Smith, Worldwide circular economy revenue 2022-2026, https://www.statista.com/statistics/1337519/circular-economy-market-revenue/, November 2023.

2 Bruna Alves, Global waste recycling services market size 2022-2032, https://www.statista.com/statistics/239662/size-of-the-global-recycling-market/, January 2023.

3 P. Lacy, J. Rutqvist, Waste to wealth: The circular economy advantage, 2016.

4 Paul Ekins and Nick Hughes, Resource Efficiency: Potential and Economic Implications, https://www.resourcepanel.org/sites/default/files/documents/document/media/resource_efficiency_report_march_2017_web_res.pdf, March 2017.

5 Rubén Michael Rodríguez-González, Does circular economy affect financial performance? The mediating role of sustainable supply chain management in the automotive industry, March 2022.

With the tightening European legislation on waste management and investment in the circular transition gaining traction, it becomes clear that circularity is no longer a buzzword, it’s a necessity for those who want to stay competitive. For the ones who don’t recognize the ongoing shift, this should serve as a wake-up call: Circularity is the new standard of doing business and first-movers are already reaping the benefits.

For the past years, the circular economy has already instigated transformative shifts across industries. In the fashion sector, for example, clothing resale is projected to surpass fast fashion by 2029, while the realm of plastics and consumer packaged goods is witnessing the metamorphosis of profit pools throughout the value chain, driven by mounting regulation, public expectations, and innovative recycling technologies1.

Governments are propelling this transformation, exemplified by the circular economy’s integral role in the European Green Deal, alongside circular economy roadmaps and regulatory measures established in nations like China, Chile, and France. As a result of this and other driving factors of circularity, the use of circular materials in the EU increased by roughly 41% between 2004 and 2021, accounting for 11.7% of total material use in 20212.

The Concept of a Circular Economy

According to McKinsey, approximately 63% of potential emissions reduction in the fashion industry is estimated to come from the use of cleaner energy sources3.

All of the other 37% of emissions reduction, however, necessitates innovative strategies: this is where circularity comes in. Processes encompassing prolonged product life cycles, shifts in consumer behaviors, adoption of circular business models, curbed overproduction, increased integration of recycled materials, and other circular economy principles could contribute immensely—up to 654 million metric tons of emissions reduction in the fashion industry by 2030, effectively bridging the emissions reduction gap. This approach can be similarly applied across various consumer goods industries3.

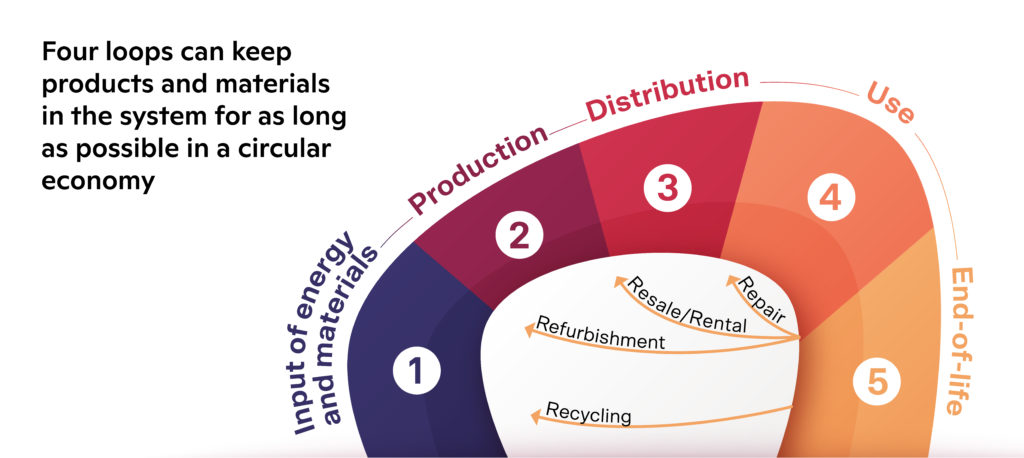

Within a circular economy framework, four pivotal loops support the extension of product life cycles: repair, resale/rental, refurbishment, and recycling.

Circularity is the Future Standard of Doing Business

It is clear that the circular economy is driving transformative changes across entire industries, opening up fresh prospects while also presenting risks for those who fail to keep pace. Embracing circular practices is becoming essential for businesses to thrive in this dynamic landscape.

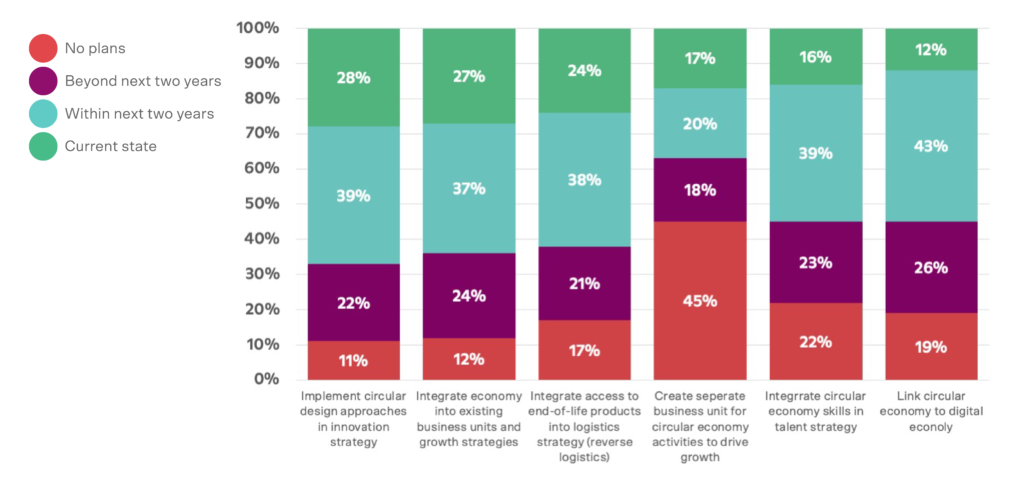

Already in 2019, roughly 28% of professionals in supply chain functions disclosed that they have incorporated circular design processes in their company innovation strategy. And around 39% stated that they plan on implementing circularity methods within the next 2 years4.

What Drives the Shift to Circularity?

Shifting consumer demand, regulation, technological progress, infrastructure, supply-side activity, and the macroeconomic environment are the main drivers of demand for circular consumer goods.

Shifting Consumer Demand

Research by McKinsey reveals that nearly 40% of European consumers consider sustainability to be of “high importance”. This heightened concern for sustainability is driving an increased demand for recycled, refurbished, and reused products. A recent survey conducted in 2021 indicates that approximately half of consumers in Germany, France, and the United Kingdom have already bought pre-owned items. As environmentally-conscious Generation Z individuals age, this trend is expected to gain further momentum3.

Regulation

Governments worldwide are progressively acknowledging the circular economy’s capacity to enhance competitiveness, foster robust supply chains, and achieve societal and environmental goals. Notably, the circular economy constitutes a fundamental element of the European Green Deal and features among the EU Taxonomy’s six environmental objectives. Several countries, including China, Chile, and France, have taken significant strides by implementing circular economy roadmaps and enacting legislation to promote sustainable practices. This growing recognition highlights the critical role of the circular economy in shaping future policies and fostering global sustainability5.

Other notable government initiatives are the Circular Economy Action Plan (CEAP) committing billions of euros to support initiatives that drive the journey towards achieving net-zero targets within the next decade. A central element of the CEAP involves a robust eco-design strategy, which emphasizes aspects like product longevity, reusability, upgrade potential, and advocating for a “right to repair.” Additionally, the plan emphasizes the integration of recycled materials, remanufacturing practices, and the promotion of high-quality recycling methods.

In the meantime, multiple European countries have begun the process of enacting extended producer responsibility measures. These initiatives offer substantial financial incentives to companies aiming to make the shift towards circular business models.

Technological Progress

Innovation progress in areas such as chemical recycling, digital product passports, and scalable disassembly technologies is allowing for the more and more accessible industrial-scale transition to circularity3.

The growing demand for solutions that facilitate product reselling, refurbishment, and recycling especially when it comes to developing scalable material collection and take-back programs, reverse logistics, as well as automated systems for material sorting, will drive further innovations in these areas, getting the industry a step closer to full circularity3.

Sources:

1 thredUP (GlobalData Market Sizing), ThredUP 2020 Resale Report,2020.

2 Bruna Alves, Circular material use rate in the European Union 2004-2021, https://www.statista.com/statistics/1316448/circular-material-use-rate-in-european-union/, June 2023.

3 Sebastian Gatzer, Stefan Helmcke, and Daniel Roos, Playing offense on circularity can net European consumer goods companies €500 billion, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/playing-offense-on-circularity-can-net-european-consumer-goods-companies-500-billion-euros, June 2022.

4 Martin Placek, Supply chain approaches to the circular economy worldwide 2019, https://www.statista.com/statistics/1182874/circular-economy-supply-chain-approach/, April 2022.

5 Bocconi University, Ellen MacArthur Foundation, Intesa Sanpaolo (2021), The circular economy as a de-risking strategy and driver of superior risk-adjusted returns, http://www.ellenmacarthurfoundation.org/publications.

• Seed investment and EIC grant combined, the startup is tapping into €4.7M to boost production in 2023 and increase tenfold its disassembly capacity in 2024.

• Belgian Prime Minister, Alexander De Croo, highlighted the importance of funding circular entrepreneurship in a visit to the startup’s warehouse in Brussels.

BRUSSELS, BELGIUM – 26 April, 2023 – Belgian startup Resortecs has raised €2.2 million in a seed investment round led by Brussels-based ScaleFund and finance&invest.brussels. Founded in 2017, the fashion tech company develops design-for-disassembly technology to make textile recycling fast, easy, and cost-efficient.

makesense_invest, AFI Ventures (the impact arm of Ventech), Trividend, and PDS Limited also joined the funding round, which follows a €2.5 million grant received from the European Innovation Council (EIC) in 2022. In total, Resortecs is tapping into €4.7 million to boost production this year and finalize the development of a continuous disassembly line, scaling up tenfold its pre-recycling processing capacity to 10T/day in 2024.

Currently, less than 1% of fashion’s production is recycled, meaning a yearly loss of materials worth €500 billion and placing the sector in the world’s top 5 polluting industries. Behind these figures is the complexity of sorting recyclable and non-recyclable materials.

With Smart Stitch™ (heat-dissolvable thread) and Smart Disassembly™ (industrial-scale thermal disassembly system), Resortecs enables brands to make textile products designed to be easily sorted and disassembled for recycling. Bershka, Decathlon, and H&M already use Resortecs’ Smart Stitch™ heat-dissolvable threads in products sold in over 60 countries.

“Our goal is to reduce the textile industry’s carbon footprint by 40 billion tonnes of CO2 by 2040. For that, we have to think big and take design for disassembly beyond fashion. Our headcount has doubled in less than 6 months. In just a few weeks, Smart Stitch™ will also be found on the world’s first mattress covers designed for disassembly, made in collaboration with Belgian sleep industry leader BekaertDeslee.” – explains Cédric Vanhoeck, Resortecs’ co-founder and CEO.

The Belgian Prime Minister, Alexander De Croo, visited the startup’s warehouse in Brussels on 26 April and highlighted the importance of investing in Belgian circular entrepreneurship:

“As Europe does not have many natural resources, we have to make a choice: we can either look at everything we have already produced as waste, or consider it as potential future raw materials to protect the planet. Innovations like this are key to strengthening our industrial competitiveness. Resortecs is a fine example of green growth and Belgian innovation that is ready to take the world!”

The fashion-tech startup that facilitates industrial-scale textile recycling is one of the 74 high-potential businesses chosen in the most competitive selection of the European Innovation Council (EIC) Accelerator.

BRUSSELS, BELGIUM – Brussels-based startup Resortecs has been selected to receive a grant worth €2.5M from the EIC Accelerator. The startup enables industrial-scale recycling in fashion thanks to high-quality, automated garment disassembly.

Currently, less than 1% of all clothing produced is recycled, largely due to the high costs and complexity in separating different textile materials prior to recycling. Resortecs solves this issue with two patented innovations: Smart Stitch™, heat-dissolvable stitching threads, and Smart Disassembly™, an industrial oven capable of separating the different components of clothing made with Smart Stitch™, all without compromising the quality or creativity of clothing.

Aligned with the EU efforts to accelerate circular fashion and progressively halt fast-fashion production, Resortecs is one of the 74 startups selected out of over 1000 applicants in what is the most competitive funding round from the EIC Accelerator. The high-potential companies will each receive grants and/or equity investments, depending on their needs.

Mariya Gabriel, Commissioner for Innovation, Research, Culture, Education and Youth said:

The new wave of innovation is currently led by deep tech start-ups that target societal challenges. I am happy to see so many of them applying to the EIC, in particular from countries that are catching up in their levels of research and innovation performance. Thanks to the European Innovation Council, they will get the support they need to accelerate their growth and lead on the next wave of deep tech.

Founded in 2017 by Cédric Vanhoeck and Vanessa Counaert, in 2021 Resortecs had already raised over €1.8M to fund R&D and start piloting their disassembly solution, now validated by over 30 global fashion giants. Winners of several awards – from the H&M Foundation Global Change Award in 2018 to the 2022 Female Founder Challenge organized by VivaTech and Société Générale just last week – the startup counts on renowned supporters, including La Maison des Startups LVMH in France, Desigual’s Awesome Lab in Spain, and the BMW Foundation’s RESPOND Accelerator in Germany.

We are thrilled to have been selected by the EIC. This sum is a stepping stone to close our current €5M fundraising round – the most ambitious so far. We want to double the team, produce new continuous disassembly systems and scale our thread production to answer the ramping demand for circular solutions coming from the EU textile industry. – Cédric Vanhoeck, co-founder & Executive Lead.

Resortecs’ Smart Stitch™ has already been used in collections such as “Genesis” in collaboration with the American made-to-measure jeans brand Unspun and with H&M for the “Circular Design Story” capsule collection. A new partnership with Spanish giant Inditex is set to hit the stores this summer. By the end of the year, the French Decathlon will launch its first model with Resortecs’ thread: a fully circular ski jacket.

Resortecs is the laureate of Viva Technology & 50inTech’s #FemaleFounderChallenge of 2022! Vanessa Counaert, our co-founder and Strategic Lead, was crowned female founder of the year for Resortecs’ innovation, scaling potential, and solution impact.

The #FemaleFounderChallenge is an initiative that puts female entrepreneurs at the front and aims to accelerate the financing of women-led startups and to urge Venture Capital (VC) funds to commit to more gender equality at all levels. Resortecs was one of the 5 finalists of the challenge, selected out of over 500 applicants from 69 countries.

As the new winner, Vanessa and Resortecs get access to a substantial platform of visibility from Viva Technology – VivaTech is the biggest European event for technology and startups. Additionally, the laureate also gets private meetings with the #FemaleFounderChallenge’s high-level VC jury, a speaking opportunity with Maddyness, mentoring sessions on fundraising with Claire Calmejane from Société Générale, and last but not least, a startup booth at VivaTech 2023.

It was very inspiring for Resortecs to be surrounded by so many female entrepreneurs, with a special shout out to the other 4 finalists: Charlotte Gaudin from AML Factory, Shusma Shankar from Deep Planet, Lilia Leye Shwartsman from MICA AI MEDICAL, and Bola Bardet from Susu.

We are looking for our next Development Engineer, are you the one?

Are you a driven Engineer with an experience in product / mechanical systems development?

If you are passionate about the circular economy, textiles, and technology, this is your opportunity to join a startup leading the clean-tech revolution that will shape the future of fashion!

Check the full job description and apply via the link below:

You will be joining a dynamic and challenging start-up environment! Resortecs is a small and driven international team that is leading the transition towards the circular economy.

This is your opportunity to have huge personal and professional growth. This position has substantial responsibilities, networking opportunities and rapid-progress learning in an innovative atmosphere.

Resortecs strives to grow an inclusive environment, where individual differences are recognized, respected, and responded to in every possible way that makes our people thrive. That’s why all applicants are given equal opportunity regardless of age, gender identity or expression, ethnic origin, nationality, language, disability, religion, socio-economic status, or sexual orientation. Each employee’s distinctive experiences, perspectives, and viewpoints help us build a more resilient, fun, and innovative future for fashion.

Are you the Innovation Engineer we are looking for?

Are you a driven Engineer with a strong interest in generating knowledge from experimentation?

If you are passionate about the circular economy, textiles, and technology, this is your opportunity to join a startup leading the clean-tech revolution that will shape the future of fashion!

Check the full job description and apply via the links below:

You will be joining a dynamic and challenging start-up environment! Resortecs is a small and driven international team that is leading the transition towards the circular economy.

This is your opportunity to have huge personal and professional growth. This position has substantial responsibilities, networking opportunities and rapid-progress learning in an innovative atmosphere.

Resortecs strives to grow an inclusive environment, where individual differences are recognized, respected, and responded to in every possible way that makes our people thrive. That’s why all applicants are given equal opportunity regardless of age, gender identity or expression, ethnic origin, nationality, language, disability, religion, socio-economic status, or sexual orientation. Each employee’s distinctive experiences, perspectives, and viewpoints help us build a more resilient, fun, and innovative future for fashion.

Join us.

Subscribe to our newsletter.

By subscribing, I agree with having my personal data stored and processed by Resortecs so I can receive future updates and marketing offers.