Resortecs Study: Estimate on the achievable target for recycled content in textile products

As the global community continues to grapple with the urgent need for sustainable solutions, the textile industry stands at a critical crossroads. With increasing awareness of environmental degradation and resource depletion, there is a growing imperative to reevaluate traditional manufacturing practices and embrace more sustainable alternatives. At the forefront of this movement is the concept of eco-design, which emphasizes the integration of environmental considerations into product development processes.

As the European Union discusses the EU Ecodesign Directive and other measures to boost textile circularity, it is clear that the environmental impact of textile products has made fashion one of the region’s top priorities in the circular transition. On average, an EU citizen consumes 26 kg of textile and generates 11 kg of waste each year. Yet only 1% of the material used in textile production is recycled — the remaining 99% is landfilled or incinerated.

Objective

In alignment with the principles of eco-design for sustainable products (ESPR), this study seeks to estimate the achievable target for recycled content in textile products, specifically apparel, that are placed on the European market. The focus is on utilizing recycled content sourced from collected textile waste within Europe over the next decade.

By leveraging recycled materials, manufacturers can reduce reliance on virgin resources, minimize waste generation, and mitigate the environmental footprint of their products. Through a comprehensive analysis of industry trends, consumer preferences, and regulatory frameworks, this report aims to provide insights and recommendations for establishing meaningful recycled content targets that promote sustainability without compromising product quality or performance.

Methodology

The study aimed to assess the potential feedstock available from collected textile waste in Europe, both with and without pre-recycling preparation such as disassembly. It investigated the amount of attainable feedstock achievable under current conditions, as well as the additional feedstock that could be obtained if pre-recycling preparation methods like disassembly were implemented.

The following assumptions were considered in the calculation:

• Global Market Size: The global market for textile products is estimated to consist of 116 billion pieces annually. Of these, the European market represents 28%, equivalent to 32.5 million pieces, with an average weight of 300g per piece, totaling 9744 tons per year. This value is assumed to remain stable over the study period despite the growth potential.

• Monomaterial Fraction: Currently, monomaterial products constitute 22% of total fashion collections. It is anticipated that this proportion will increase due to eco-design requirements (ESPR), reaching 30% by 2035.

• Composition of Materials: PET accounts for 12% of the material composition, while cotton represents 40%. The recycling efficiency is estimated at 47% for PET and 49% for cotton, accounting for material loss during recycling processes such as melt spinning, twining/spinning, weaving, and confection.

• Disruptors and Multimaterial Products: Products made from mono-materials and containing recycling disruptors such as zippers, labels, and buttons comprise 69% of total fashion pieces7. Multi Material products constitute 9% of the total fashion pieces7.

• Textile waste collection rate: The average textile collection rate in Europe is currently estimated at 38% with the aim of achieving 100% with the mandatory textile waste collection.

Data Analysis

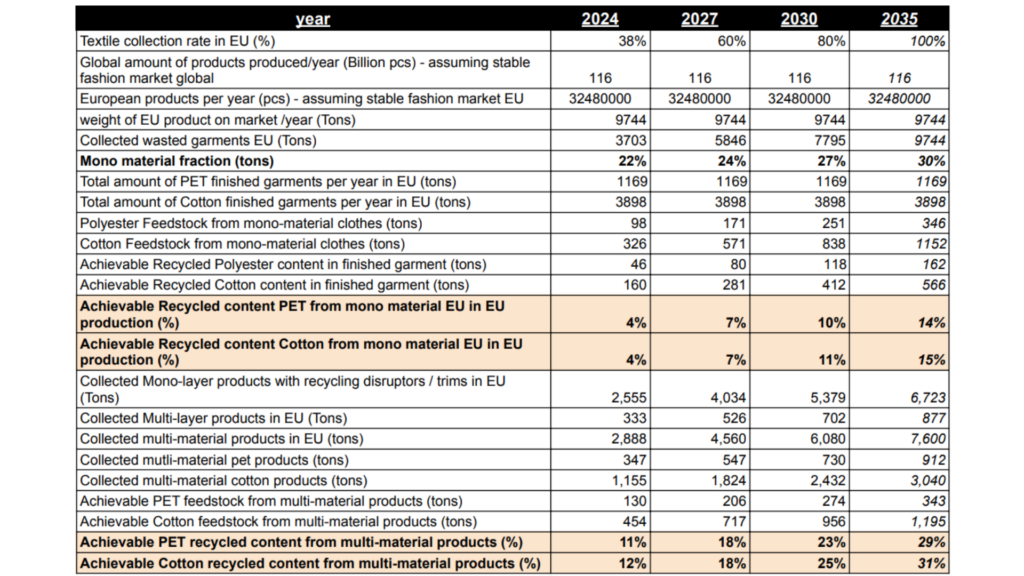

In the light of the waste framework directive WFD EC 2008/98 and the mandatory collection of separated textile waste the percentage of the collection rate is expected to increase from the present state of 38% to 60% in 2027, up to 80% in 2030 and 100% by 2035.

The mono-material fraction currently constitutes around 22% of the total garments in the EU market. With the implementation of eco-design requirements and the potential for garments to be designed as mono-material, eliminating the need for trims or multi-material components to meet performance and durability standards, this fraction is projected to rise to 30% by 2035. Accordingly, given the current collection rate of 38% of textile waste in Europe, the textile industry can procure 98 tons of polyester feedstock and 326 tons of cotton feedstock in 2024.

This volume of feedstock will be adequate to meet the requirement for 4% recycled content in new garments without necessitating any modifications to current practices or additional investments. With the aim of achieving collection rates of up to 100% in the EU, the potential feedstock obtainable from mono-material textile waste collected in Europe is anticipated to amount to at least 346 tons of cotton feedstock and 1152 tons of polyester feedstock. This could potentially translate into achievable recycled content targets of 14% to 15% by 2035, respectively.

Table 1: Potential textile recycled content targets and their feasibility in the EU.

Tapping into multi-material textile products, which may consist of mono-material with recycling disruptors or multi-layer compositions, and assuming they are prepared for recycling through effective disassembly, the achievable PET feedstock is projected to increase from 130 tons in 2024 with a 38% collection rate to 343 tons in 2035 with a 100% textile waste collection rate. Consequently, the achievable PET recycled content from multi-material sources will range from g.

A similar trend is expected for cotton feedstock, estimated at 454 tons in 2024 and evolving to 1195 tons if 100% of multi-material apparel waste is collected and disassembled in Europe. This will result in achievable cotton recycled content ranging from 12% to 31%.

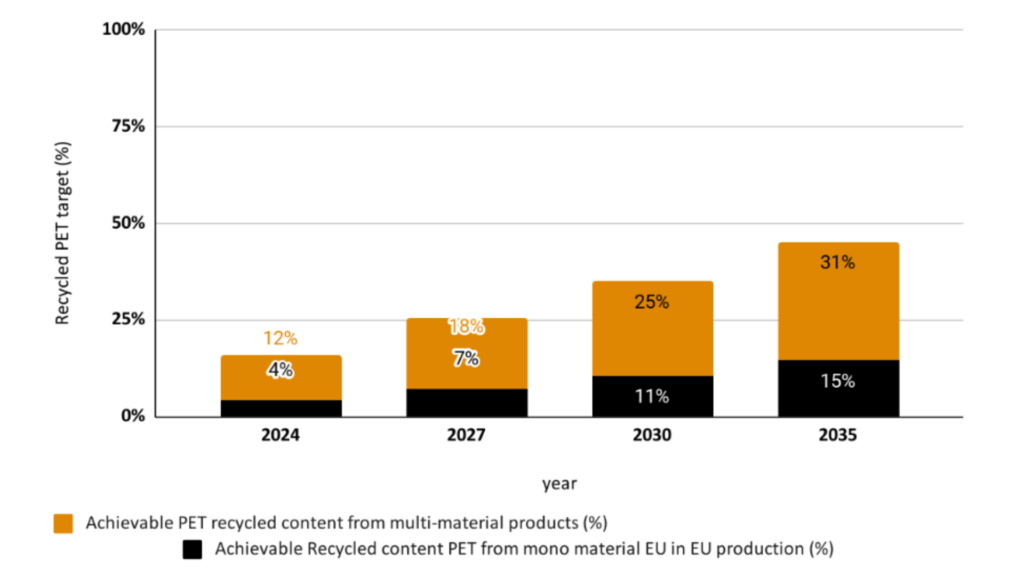

Combining the potential PET feedstock collected in Europe from both mono-material and multi material apparel products will result in 16% of achievable recycled PET target in 2024 with projection to increase to 45% by 2035, as demonstrated in Figure 1.

Figure 1: Achievable Recycled PET Content (%) from Mono-Material and Multi-Material Textile Waste Collected in the EU.

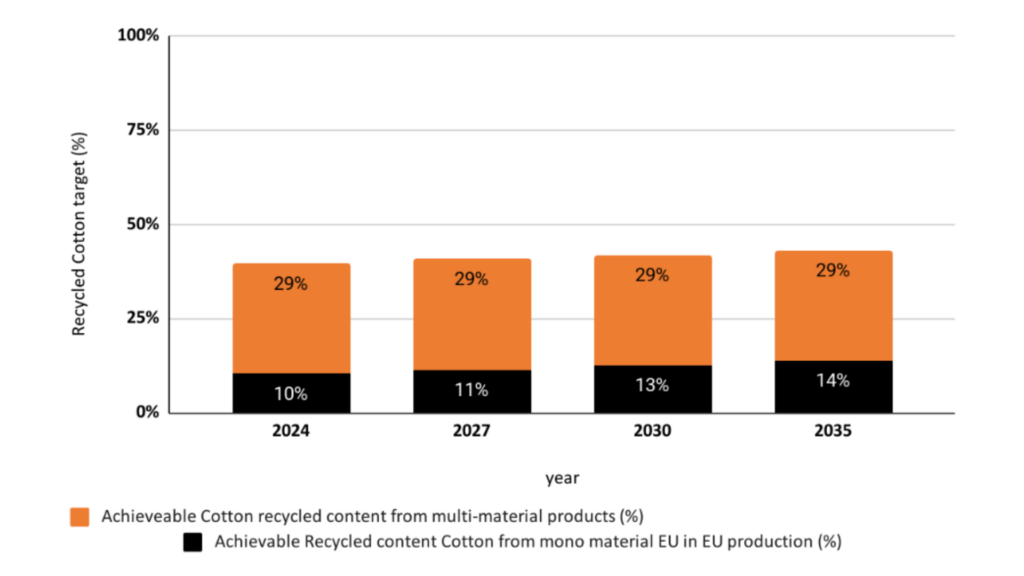

Combining the potential cotton feedstock collected in Europe from both mono-material and multi material apparel products will result in 39% of achievable recycled cotton target in 2024 with projection to increase to 43% by 2035, as demonstrated in Figure 2.

Figure 2: Achievable Recycled Cotton Content (%) from Mono-Material and Multi-Material Textile Waste Collected in the EU.

Conclusion

The study’s results underscore the tangible potential for achieving significant levels of recycled content in new apparel products. The min achievable recycled content target is 4% from mono-material garments without changing any current practices that could rise to 14% when 100% of textile collection rate is attained. By tapping into multi-material garments after preparation for recycling, a min achievable recycled content target is 11% with potential to rise to 31% when 100% of multi-material textile collection rate is attained. With careful management of current European textile waste, a realistic recycled content target of 15% is within reach. Looking ahead, as textile waste collection becomes mandatory and reaches 100% penetration over the next decade, the projected recycled content target could soar to an impressive 43%. It’s crucial to note that while market growth may amplify these volumes, our study prioritizes responsible production practices and expects products to have longer lifespans in the market, and it didn’t consider any market growth.

The study findings highlight the pivotal role of the disassembly process, exemplified by Resortecs’ design for disassembly solution. Effective preparation of products for recycling will unlock higher volumes of feedstock with the necessary purity for textile-to-textile recycling processes. This optimization not only streamlines the sorting process and increases recycling yields, but also generates financial benefits for sorters and recyclers. Moreover, it significantly mitigates environmental impact by reducing waste generation and curbing the need for new material sourcing. This emphasizes the imperative for defining eco-design requirements that foster an enabling environment for textile-to-textile recycling, thereby actualizing the waste hierarchy. Such an environment must prioritize pre-recycling techniques like disassembly and set ambitious recycled content targets that not only reflect high percentages but also ensure the origin of recycled content is sustainable and traceable. This holistic approach is essential for driving meaningful progress towards a circular and sustainable textile industry.

Sources

1. 2009/125/EC

2. Textiles in Europe’s circular economy, EEA, 19 Nov 2019.

3. A new textile economy: redesigning fashion’s future (Ellen MacArthur Foundation) – Circular Fibers Initiative analysis.

4. Statista – Apparel Europe, and Apparel Market Worldwide.

5. Global apparel market: The revenue of the global apparel market was calculated to amount to 1.53 trillion U.S. dollars in 2022 while Apparel – Europe: In 2023, the revenue in the Apparel market in Europe is estimated to be US$474.40bn hence the EU market share of the global apparel market is 28%.

6. Resortecs internal calculation for an average garment weight.

7. Refashion, Characterisation study of the incoming and outgoing streams from sorting facilities report, 2023.

8. Fashion For Good, Sorting for Circularity Report, 2022.

9. Recycling efficiency was estimated on analysis of current recycling technology and industrial discussions with developing recycling technologies at lower TRL.

10. EU exports of used textiles in Europe’s circular economy – Feb 2023.

11. European Directive ((EU) 2018/851) amending Directive 2008/98/EC

The Industry is Changing

The textile industry is undergoing a significant transformation driven by various global factors. Climate change, tightening legislation, geopolitical tensions, resource depletion, and the de-globalization of trade are leading to a paradigm shift in business operations.

Discover Resortecs’ comprehensive guide on how textile players can navigate these challenges and take control of their value and supply chains to mitigate the industry’s most significant risks of the decade.

Key Risks Facing the Textile Industry

Risk 1: High Volatility of the Availability and Price of Natural Raw Materials

The availability and pricing of natural raw materials are becoming increasingly unpredictable due to climate change and resource depletion.

Risk 2: High Volatility of the Availability and Price of Recycled Material

Recycled materials are facing similar volatility issues, influenced by market demand, legislation, and sustainability practices.

Risk 3: Market Access Challenges

Geopolitical tensions and shifting trade policies are creating barriers to market access, impacting global supply chains.

Risk 4: Lead Time Issues Due to Logistical Perturbations and Disruptions

Logistical challenges, such as transportation delays and disruptions, are causing significant lead time issues, affecting the timely delivery of goods.

Risk 5: Costly EPR Fees

Extended Producer Responsibility (EPR) fees are increasing operational costs, necessitating efficient waste management and recycling processes.

Risk 6: Growth of Second-Hand C2C Channels

Increasing popularity of consumer-to-consumer (C2C) second-hand platforms

that propose a price competitive and sustainable offer.

Risk 7: Growth of Ultra-Fast Fashion

The rise of ultra-fast fashion brands offering extremely low prices is driving consumers away from higher priced more sustainable fashion products.

Take Control of Your Supply Chain

Brands need a comprehensive and systematic strategy to address these multifaceted risks, incorporating eco-design, design for disassembly, and circular economy practices as essential elements. Resortecs’ Smart Stitch™ and Smart Disassembly™ technologies enable efficient disassembly and recycling of textile products, allowing brands to reclaim double the amount of feedstock from discarded textiles up to 15 times faster and at the highest purity levels.

Proactively address the textile industry’s biggest risks with Resortecs’ advanced solutions. Achieve compliance, operational efficiency, and financial ROI through innovative technologies designed to enhance sustainability and streamline supply chains.

Click Here to Download the Full Guide

Gain deeper insights into how you can mitigate crucial risks in the textile industry by downloading Textile Sourcing & Market Access Risks.

Garments and accessories are often complex composites, made from various materials to meet distinct requirements. For example, shoes consist of a rubber sole paired with an upper made of leather or fabric. Tailor-made suits feature horsehair reinforcements in the front and lapel, combining wool exteriors with silk, viscose, or nylon linings. Winter jackets are filled with feathers, sandwiched between water-repellent fabric and synthetic linings.

For end-of-life treatments, these composite products present challenges. Each material requires a unique recycling process. To maintain the quality of recycled materials, components like the rubber sole of a shoe must be separated from the leather or fabric upper. This principle applies to all composite garments. Each material must be separated to ensure it can be reused in its pure, high-quality form.

Unfortunately, most apparel is not designed for easy disassembly. Disassembling different materials currently requires a labor-intensive and manual process. Consequently, “recycled” garments and accessories are often shredded into a low-quality textile mixture. Effective recycling and repair are virtually nonexistent.

To truly implement a circular economy and protect our future prosperity, we must consider product structures and hierarchy. Effective repair, remanufacturing, and recycling demand that garments and accessories be modular. Achieving this necessary modularity involves using reversible joining methods and prioritizing design for disassembly.

Resortecs is at the forefront of this revolution, providing design-for-disassembly solutions that enable high-quality textile recycling on an industrial scale. By pioneering innovative threads and disassembly techniques, Resortecs empowers brands, sorters, and recyclers to address today’s environmental challenges at the pace and scale the Earth needs.

Resortecs combines thermal engineering, eco-design, and chemical engineering to offer state-of-the-art solutions that empower the entire textile value chain to close the loop. Discover Smart Stitch™ and Smart Disassembly™: Resortecs’ solution for multi-material disassembly in a fast, easy, and cost-efficient manner. To learn more about the financial impact of design for disassembly, dive into the From Waste to Profit report.

Smart Stitch™ is a range of 16 heat-dissolvable threads – enabling automatic thermal disassembly and design for recycling. Suitable for a variety of applications, from apparel to fire-resistant workwear, the Smart Stitch™ threads have been exhaustively tested on various production line configurations and are compatible with every stitching machine widely available on the market.

Smart Disassembly™ is the world’s first thermal disassembly system – combining the quality of manual methods with the speed of mechanical processes. A fully automatic process empowering sorters and recyclers to disassemble textile products while removing zippers, elastic bands, and any other trims that hinders recycling 5x faster than manual disassembly. The low-oxygen chamber ensures no risks of fabric oxidation and recyclability rates as high as 90%.

When you hear “circular economy,” think “modular.” This shift in perspective is essential for fostering sustainable fashion and advancing circular design principles.

Photo by Ethan Bodnar on Unsplash

The importance of yields in scaling industrial textile-to-textile recycling.

Textile recycling and circularity are becoming crucial points to be addressed for the survival of the textile industry. The surge in urgency in recent years is facilitated by the increasingly tightening regulations on handling textiles at end-of-life and the mandatory use of recycled content, as well as changing demands from critical stakeholders such as investors, media, and end-users.

In the discussions around closing the loop for the textile industry, one thing remains hidden: technology alone will not be enough. To make post-consumer textile-to-textile recycling the new norm, it needs to become profitable. And work is still required to achieve that profitability by scaling processes and increasing their efficiencies. Without tackling the low yield of current textile-to-textile recycling supply chains, recycling feedstock capacity and profit margins for textile players will remain at risk. This poses a bigger concern on achieving a closed loop at an European level, compromising EU’s future competitiveness in the market.

Big strides have been achieved in reaching the required recycled feedstock levels, yet innovative recycling technologies alone are not sufficient. Textile-to-textile recycling must evolve to be both financially viable and operationally scalable.

“Textile-to-textile recycling must evolve to be both financially viable and operationally scalable.”

When industrialising new processes, a key metric to consider is the productivity and efficiencies – i.e. yields. As argued in the study ‘The Economics of Yield-Driven Processes’ by Roger E. Bohn and Christian Terwiesch, the economic performance of production processes is heavily influenced by process yields, as these have a substantial impact on product cost, gross revenue and contribution margin. According to research on the hard disk drive (HDD) industry, the report states: “A three percentage point increase in yields can be worth about 6% of gross revenue and 17% of contribution. In fact, an eight percentage point improvement in process yields can outweigh a US$20/h increase in direct labour wages”.

In textile recycling, the level of contamination or the purity of feedstock has the most pronounced impact on yields. Some contaminations, such as elastane, are completely blocking the majority of mechanical and chemical recycling processes, while others are simply classified as waste, directly increasing overall process costs.

With 78% of apparel composed of various components, the pressing question arises: which pre-processing method maximises efficiency to achieve high yields throughout the process?

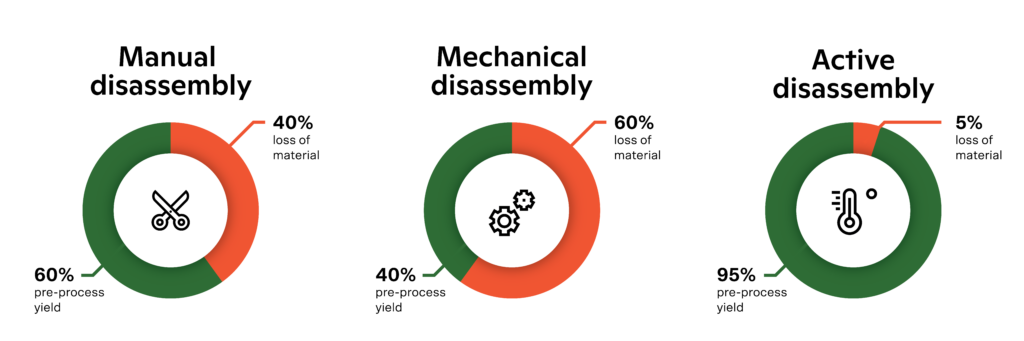

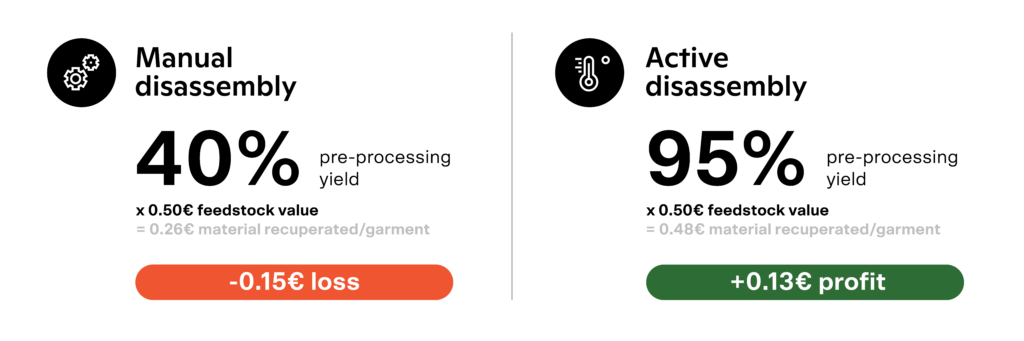

On average, trims represent 10-20% of the garment weight. Mechanical removal of trims from the textiles, also called mechanical disassembly, results in the loss up to 60% of the garment (depending on the desired output purity requirements). Manual disassembly fares slightly better, but still incurs losses ranging around 40%. For a deeper dive into the cost analysis of textile disassembly processes, refer to Resortecs’ From Waste to Profit report.

Those pre-processing yields, combined with the average yield of 80% from chemical recycling processes result in an overall post-consumer textile-to-textile recycling process with yields as low as 32%. This strikingly low yield metric underscores that price competitive recycled materials will take time to materialise. It is unsurprising that post-consumer textile-to-textile recycled materials remain costly, and why recycled PET bottles (which bypass the need for disassembly or component sorting) continue to dominate as the most popular recycled material source in the textile industry. As Leachman documented in 1996 with the Berkeley project on HDD manufacturing, a yield rate of 50% effectively doubles the costs per unit compared to those at a 100% yield.

With eco-design solutions such as Resortecs, the disassembly or “de-stitching” of garments is automated, allowing for the elimination of trims and the separation of two different textiles in reusable fractions with an average material recuperation rate of 95%. This pre-processing technology not only facilitates the recycling of complex/multilayer textile products, such as denim, jackets and swimwear, but also roughly doubles the post-consumer textile recycling yields.

Despite the widespread recognition of the crucial role yields play, it is surprising how little emphasis is placed on discussions regarding efficiencies and productivity at annual textile circularity and recycling conferences. Similar to the semiconductor industry in the 1990s, prioritising yields is imperative when deciding on which technologies and processes to integrate. By increasing the pre-processing and recycling yields we will be able to industrialise textile-to-textile recycling and achieve price-competitive sustainable materials for the textile industry.

In conclusion, the journey towards mainstream textile-to-textile recycling hinges on maximising process yields and optimising efficiency across the value chain. As described above, an optimised eco-design has a significant impact on the recycling process yields and thus largely affects the price of recycled content textile brands have to pay to be compliant. This insight highlights an opportunity for textile players to switch from a reactive to proactive approach: brands must take action in the way their garments are designed to ensure low price recycled feedstock, leading to less compromise on their margins in the long-term.

By addressing pre-processing challenges and leveraging eco-design technologies like Resortecs, the industry can pave the way for price-competitive sustainable materials and drive the transition towards a circular economy in the textile sector.

Author: Cédric Vanhoeck, CEO at Resortecs

Resortecs has joined forces with Decathlon, the global leader in sports equipment and apparel, to develop a fully recyclable swimwear collection without compromising performance, functionality, or aesthetics. This collaboration blends state-of-the-art technology with high-performance design.

Acerina Trejo Machin, the Chief Technology Officer at Resortecs, explains, “We all know that a high percentage of elastane prohibits the recycling of fabrics, but eliminating elastane lowers the functionality and performance of a garment. To balance performance and recyclability, Decathlon developed Negombo, a fabric ensuring elasticity without the use of elastane.”

However, creating a swimwear garment with a recyclable fabric alone isn’t enough to meet the required performance and comfort, for which elastic bands are needed. Those elastic bands are not processable by recyclers and block the recycling of the swimwear. This is where Resortecs comes into play. Resortecs’ Smart Stitch™, combined with Smart Disassembly™, enables the efficient separation of the elastic bands from the main fabric at the end of the garment’s life cycle.

Acerina elaborates, “Resortecs’ active disassembly process ensures the maximum recyclability rate of the swimwear garment. Our technology allows for fully automatic disassembly, without any manual intervention, at a scale of up to 10 tons a day. This results in an impressive 63% increase in material recovery and is 10 times faster than conventional methods.”

The synergy between Resortecs and Decathlon allows for the creation of swimwear that is not only high-performing but also fully recyclable, without making any compromises in design, durability, or comfort.

Closing the loop has never been easier. By incorporating Resortecs’ disassembly solution, product designers can ensure circularity while focusing on their ultimate goal: creating garments that best fit their customer needs.

In recent years, a significant transformation has been underway in the world of finance, with Environmental, Social, and Governance (ESG) considerations taking center stage. This shift is not merely ideological but stems from a growing recognition among financial decision-makers that sustainable practices are not only ethically sound but also financially lucrative. As corporations face mounting pressure to address societal challenges, a parallel movement is unfolding, propelling the circular economy into the spotlight as a lucrative investment opportunity. This change can be attributed to various factors.

1. In a shifting landscape, financial decision-makers with aspirations beyond mere monetary gains are demanding tangible actions from corporations. The prevailing sentiment acknowledges that Environmental, Social, and Governance (ESG) considerations not only serve as risk indicators but also foster enduring expansion and cultivate novel avenues of value by supporting entities that are actively addressing the current social challenges. Insights from Opimas and the Global Sustainable Investment Alliance unveil a staggering surge in ESG investments, exceeding $40 trillion in 2020 from a baseline of $23 trillion in 2016. Projections by Deutsche Bank underscore an imminent paradigm shift, suggesting that a substantial 95% of assets under management, equating to $130 trillion, will align with ESG principles by 20301.

2. Concurrently, governmental bodies, regulatory authorities, and central banks are realigning public expenditures and policy frameworks to facilitate the shift toward an all-encompassing, environmentally conscious circular economy. The configuration of investment opportunities is transforming, evolving beyond being a fad to manifest as a substantial and widespread movement1.

“Over the last 18 months, funds that focus on environmental-focused investments have outperformed almost all other forms of index, some people will call that a momentum investment. I would call that a sea change, I would call that a recognition that we have to move forward fast. Larry Fink, CEO, BlackRock 13 August 20211.

These factors have resulted in a substantial upswing in dedicated financing activities to offer investors a wider array of options to align their portfolios with sustainable and circular practices, leading to the emergence of different debt and equity instruments tailored to support circular economy initiatives.

Among these financial instruments are public equity funds (their number increasing from 2 in 2018 to 13 in 2021 including funds from the world’s largest investors BlackRock, BNP Paribas, Credit Suisse, and Goldman Sachs), corporate and sovereign bonds, venture capital, private equity (tenfold increase in the number of private market funds from 2016 to H1 2020), and private debt. Financial institutions have also actively participated in driving circular economy initiatives through bank lending, project finance, and insurance solutions2.

One example of the financial sector’s commitment to sustainable and circular practice is the exceptional growth in assets under management (AUM) in public equity funds centered around the circular economy. Between December 2019 and the first half of 2021, AUM skyrocketed from $0.3 billion to an astounding figure exceeding $9.5 billion at the end of November 2021, demonstrating a 28-fold in less than 2 years2.

Additionally, between December 2019 and December 2021, the issuance of corporate and sovereign bonds centered around the circular economy witnessed an impressive 5-fold increase. Over the past three years, a minimum of 40 such bonds were issued, highlighting the growing interest and commitment towards financing circular economy initiatives2.

Last, but not least, index providers are diversifying their offerings to encompass the circular economy domain, unveiling a host of new specialized products. Here are a few examples:

— Solactive has taken the lead by introducing an index with a focus on the sharing economy.

— Morgan Stanley Capital International (MSCI) has entered the scene with its index that highlights the circular economy and renewable energy.

— ECPI group has launched the Circular Economy Equity Leader Index, designed to capture companies excelling in various circular economy aspects3.

This remarkable financial mobilization highlights the confidence of stakeholders that the circular economy is not just an ethical choice but also an increasingly lucrative investment opportunity.

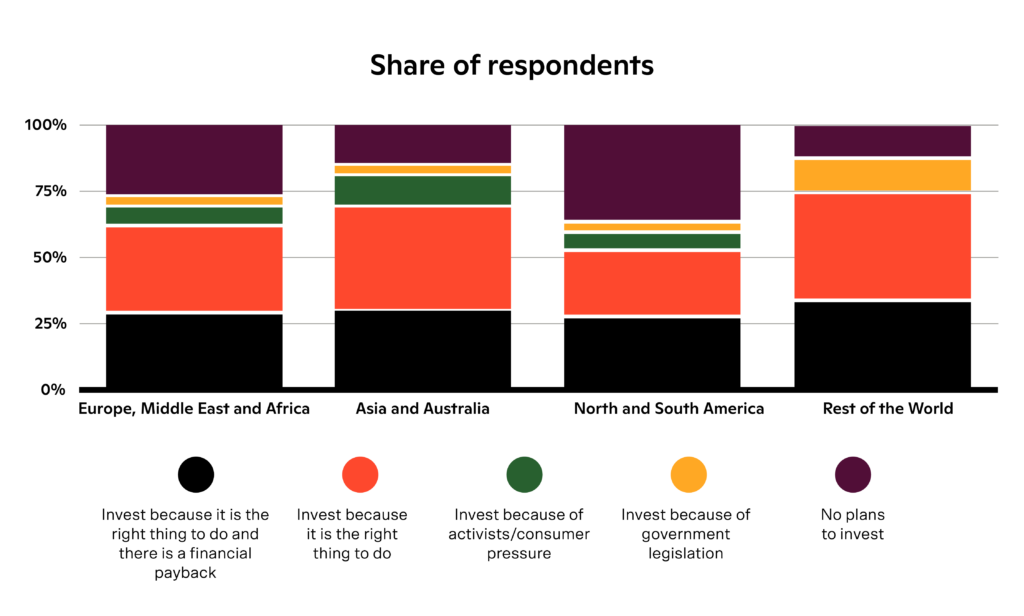

That confidence is also supported on the individual level. Naturally, many investors choose to invest in the circular economy because it is the right thing to do. However, it becomes obvious that increasingly, investors recognize the financial potential of such investments. Roughly one-third of investments in the circular economy in Europe, the Middle East, Africa, Asia, Australia, and North and South America are recognising the increasing returns4.

The rising confidence from financial institutions and individuals is not without support. A recent analysis by Bocconi University of 200+ European publicly listed companies supports the idea that circularity is the new winning strategy for investors looking to de-risk their investments and deliver superior risk-adjusted returns2.

The circular economy as a strategy to de-risk debt

In recent years, it has become increasingly clear that factors such as climate change, other climate-related crises, rising geopolitical tensions, and other societal challenges pose significant investment risks, and the financial sector is recognizing that. All actors in the financial system should work towards avoiding a climate-driven ‘Minsky moment’.

The recent analysis highlights that the more circular a company is the lower the risk of defaulting2. A 0.1 increase in Circularity Score (scoring developed by Bocconi University and Intesa Sanpaolo) is responsible for the reduction in the probability of default on debt by 8.63% (one-year timeline) and by 4.93% (five-year timeline)2.

The circular economy as a strategy for superior risk-adjusted returns

The same analysis concludes that the more circular a company is, the higher the risk-adjusted returns it generates on investment2.

Public equity funds with circular economy as a sole or partial investment focus on average performed 5.0 percentage points better than their Morningstar category benchmarks in the first half of 20202.

Potential drivers of these circular economy benefits include:

— a focus on design and business model innovation and diversification

— achieving greater resource decoupling

— anticipation of stricter regulation

— changing customer preferences

— resource scarcity

As the world grapples with pressing environmental and social challenges, the circular economy emerges not only as a solution but also as a lucrative investment opportunity. By embracing sustainable practices and innovative business models, investors can not only contribute to a more resilient and equitable future but also reap substantial financial rewards. In an era where the intersection of profitability and sustainability is increasingly recognized, the circular economy stands poised to redefine the landscape of finance for years to come.

Sources:

1 Mark Carney, Unlocking the Value of the Circular Economy, https://ellenmacarthurfoundation.org/articles/unlocking-the-value-of-the-circular-economy, August 2021.

2 Bocconi University, Ellen MacArthur Foundation, Intesa Sanpaolo (2021), The circular economy as a de-risking strategy and driver of superior risk-adjusted returns, http://www.ellenmacarthurfoundation.org/publications.

3 Mara Steinbrenner, Financing Circular Economy, https://neosfer.de/en/financing-circular-economy/, September 2022.

4 Martin Placek, Circular economy investment motives and decisions worldwide in 2019, by

region, https://www.statista.com/statistics/1182841/circular-economy-investment-decision-region/, April 2022.

The Circular Economy has emerged as a pivotal economic model, offering not only sustainability but also significant financial opportunities. With projections indicating exponential growth, understanding its profitability is crucial for businesses and policymakers alike.

Current State and Forecast

The worldwide revenue of circular economy transactions was estimated to total roughly $339 billion in 20221. This is forecasted to more than double by 2026, reaching a $712 billion market opportunity. Keep in mind that this estimation only takes into account the categories of secondhand, rental, and refurbished goods, leaving aside a large pool of major circular business models, such as recycling. Including those in the equation would likely increase the value of the economy significantly, considering the projected value of the global waste recycling services market size of $88 billion, which in turn registers a 4.79% annual growth (CAGR) for the period 2020-20302.

In a forward-looking perspective, delving into the future reveals the potential of the Circular Economy to contribute an extra $4.5 trillion to global economic output by 2030, a figure that could surge to a remarkable $25 trillion by 20503. Additionally, the projections by The World Economic Forum highlight the transformative impact of recycling, reuse, and remanufacturing, suggesting that by 2025, these practices could unleash annual untapped resource savings of $1 trillion. Looking even further ahead, this value is predicted to double, reaching an impressive $2 trillion per year by 20504.

McKinsey’s Projections

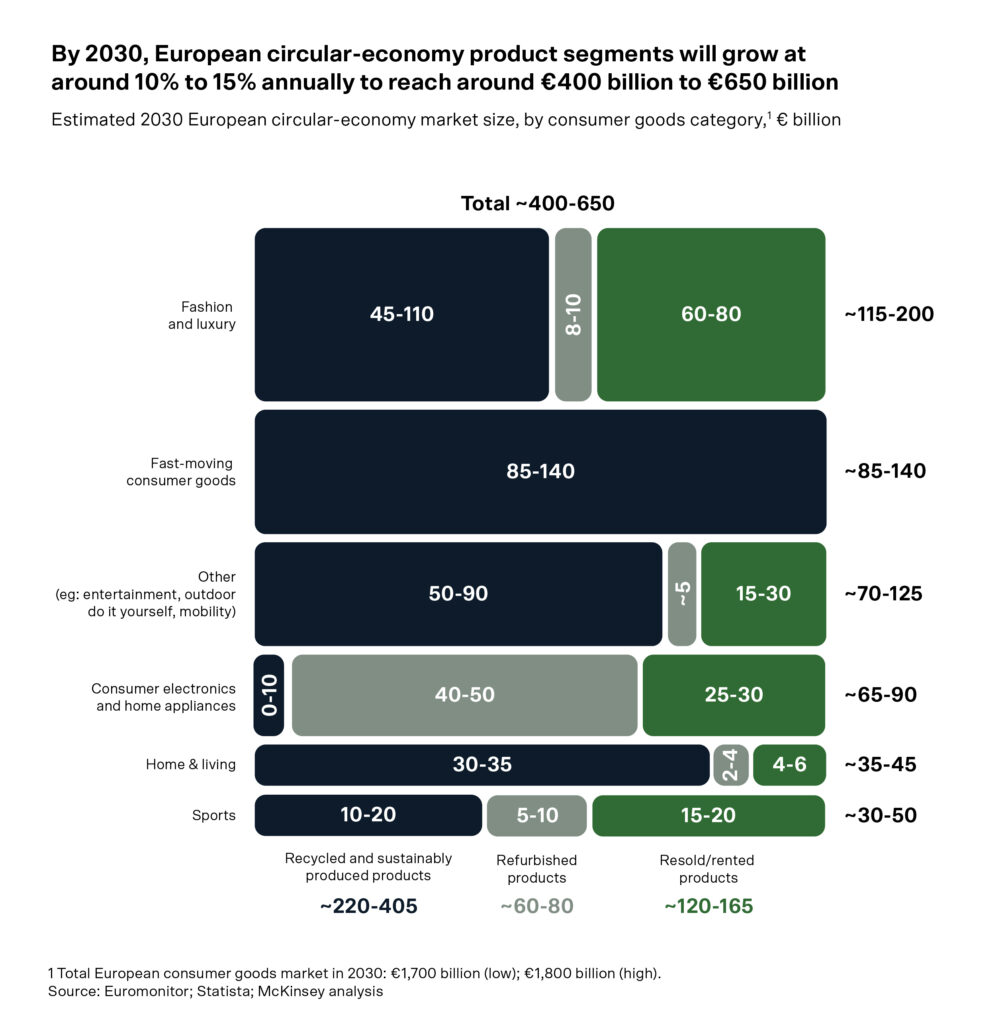

According to McKinsey’s projections, European consumer goods companies can achieve circular value pools exceeding €500 billion in annual revenues by 2030 through portfolio transformation, green business expansion, green premiums, and circular-focused operations. This significant shift will be propelled by changing consumer preferences, especially among younger generations who are using their purchasing power to express their values.

Zooming in on the added value per industry, McKinsey estimates that in FMCG, recycled and sustainably produced products are expected to see 15 to 25 percent annual growth (CAGR) until 2030, while recycling in fashion is expected to record 15 to 30 percent CAGR, generating €45 billion to €110 billion of annual value.

Part of the added value would be due to more efficient raw material usage. McKinsey reports that a circular economy would allow Europe, which is very resource-dependent, to grow resource productivity by up to 3% yearly. This transition is expected to generate a primary resource benefit of as much as €0.6 trillion annually by 2030 to the EU economy. Additionally, the forecast for non-resource and externality benefits is €1.2 trillion, bringing the annual total benefits to around €1.8 trillion.

This would translate into a GDP increase of as much as 7 percentage points relative to the current development scenario, with additional positive impacts on employment.

Drivers of Circular Economy

The reasons for the profitability of the Circular Economy are, among others, tax subsidies or preferential treatments from the government, a better competitive advantage, the reuse of waste into new products, and more efficient use of raw materials and energy consumption. Therefore, oftentimes, the benefits associated with circularity are greater than the involved costs5.

The profitability of the Circular Economy is multifaceted, encompassing tax incentives, competitive advantages, and resource efficiency. As benefits outweigh costs, embracing circularity presents not only sustainability but also financial gains for stakeholders.

Sources:

1 P. Smith, Worldwide circular economy revenue 2022-2026, https://www.statista.com/statistics/1337519/circular-economy-market-revenue/, November 2023.

2 Bruna Alves, Global waste recycling services market size 2022-2032, https://www.statista.com/statistics/239662/size-of-the-global-recycling-market/, January 2023.

3 P. Lacy, J. Rutqvist, Waste to wealth: The circular economy advantage, 2016.

4 Paul Ekins and Nick Hughes, Resource Efficiency: Potential and Economic Implications, https://www.resourcepanel.org/sites/default/files/documents/document/media/resource_efficiency_report_march_2017_web_res.pdf, March 2017.

5 Rubén Michael Rodríguez-González, Does circular economy affect financial performance? The mediating role of sustainable supply chain management in the automotive industry, March 2022.

©Filip Ysenbaert

De Tijd and its French-speaking counterpart L’Echo have proudly unveiled their esteemed selection of 30 Belgian companies leading the charge in combating climate change. Under the banner of “Changemakers,” this initiative celebrates organizations showcasing exemplary commitment and innovation in environmental stewardship. Among these distinguished nominees stands Resortecs, alongside other strong innovators like Purfi, Renewi, and Protealis.

The Changemakers initiative aims to spotlight companies that excel in leveraging technology, products, services, or business models to tackle climate change and protect the environment. Acknowledging the pressing need for collective action, De Tijd and L’Echo underscore the pivotal role of businesses in addressing this global challenge.

The nominated companies represent diverse sectors, including energy, software, construction, food, textiles, waste management, and recycling.

“Climate change stands as one of the most critical economic and societal challenges of our era,” states Isabel Albers, Editor-in-Chief of De Tijd and L’Echo. “We firmly believe that the innovative spirit and entrepreneurial drive of our companies are essential in tackling these challenges.”

Under the guidance of environmental economics professor Steven Van Passel from the University of Antwerp, a professional jury will select two standout companies – one startup and one established enterprise – as the ultimate Changemakers. Additionally, De Tijd and L’Echo subscribers will have the opportunity to cast their votes for their preferred Changemaker.

The distinguished jury panel includes industry luminaries and experts such as Julie Lietaer (European Spinning Group), Piet Colruyt (Impact House), Ignace Schops (Bond Beter Leefmilieu), Bertrand Piccard (Solar Impulse), Stéphanie Fellen (Smart2circle), François Gemenne (University of Liège), and Julien Pestiaux (Climact).

Voting for the Changemaker awards is now open to subscribers, with the winners set to be announced on March 12.

For more information about the Changemakers initiative and to cast your vote, visit Changemakers.be and tijd.be.

With the tightening European legislation on waste management and investment in the circular transition gaining traction, it becomes clear that circularity is no longer a buzzword, it’s a necessity for those who want to stay competitive. For the ones who don’t recognize the ongoing shift, this should serve as a wake-up call: Circularity is the new standard of doing business and first-movers are already reaping the benefits.

For the past years, the circular economy has already instigated transformative shifts across industries. In the fashion sector, for example, clothing resale is projected to surpass fast fashion by 2029, while the realm of plastics and consumer packaged goods is witnessing the metamorphosis of profit pools throughout the value chain, driven by mounting regulation, public expectations, and innovative recycling technologies1.

Governments are propelling this transformation, exemplified by the circular economy’s integral role in the European Green Deal, alongside circular economy roadmaps and regulatory measures established in nations like China, Chile, and France. As a result of this and other driving factors of circularity, the use of circular materials in the EU increased by roughly 41% between 2004 and 2021, accounting for 11.7% of total material use in 20212.

The Concept of a Circular Economy

According to McKinsey, approximately 63% of potential emissions reduction in the fashion industry is estimated to come from the use of cleaner energy sources3.

All of the other 37% of emissions reduction, however, necessitates innovative strategies: this is where circularity comes in. Processes encompassing prolonged product life cycles, shifts in consumer behaviors, adoption of circular business models, curbed overproduction, increased integration of recycled materials, and other circular economy principles could contribute immensely—up to 654 million metric tons of emissions reduction in the fashion industry by 2030, effectively bridging the emissions reduction gap. This approach can be similarly applied across various consumer goods industries3.

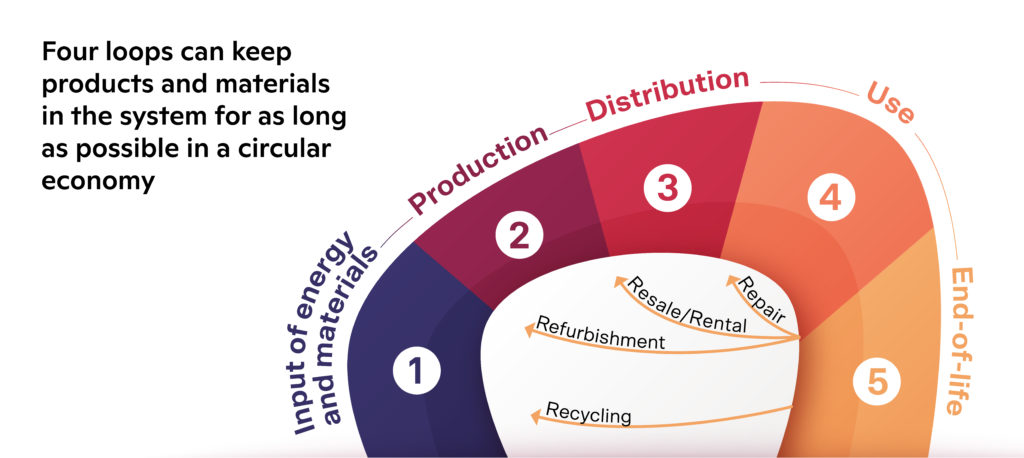

Within a circular economy framework, four pivotal loops support the extension of product life cycles: repair, resale/rental, refurbishment, and recycling.

Circularity is the Future Standard of Doing Business

It is clear that the circular economy is driving transformative changes across entire industries, opening up fresh prospects while also presenting risks for those who fail to keep pace. Embracing circular practices is becoming essential for businesses to thrive in this dynamic landscape.

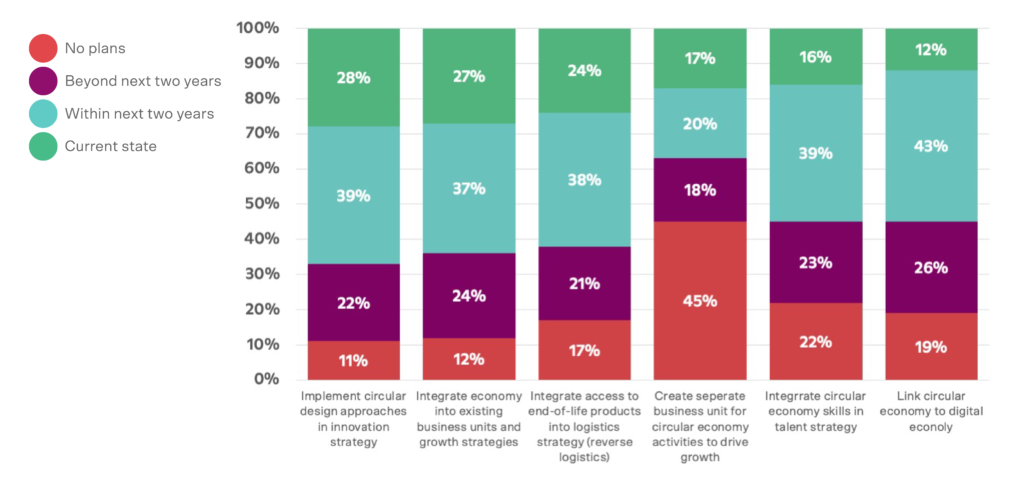

Already in 2019, roughly 28% of professionals in supply chain functions disclosed that they have incorporated circular design processes in their company innovation strategy. And around 39% stated that they plan on implementing circularity methods within the next 2 years4.

What Drives the Shift to Circularity?

Shifting consumer demand, regulation, technological progress, infrastructure, supply-side activity, and the macroeconomic environment are the main drivers of demand for circular consumer goods.

Shifting Consumer Demand

Research by McKinsey reveals that nearly 40% of European consumers consider sustainability to be of “high importance”. This heightened concern for sustainability is driving an increased demand for recycled, refurbished, and reused products. A recent survey conducted in 2021 indicates that approximately half of consumers in Germany, France, and the United Kingdom have already bought pre-owned items. As environmentally-conscious Generation Z individuals age, this trend is expected to gain further momentum3.

Regulation

Governments worldwide are progressively acknowledging the circular economy’s capacity to enhance competitiveness, foster robust supply chains, and achieve societal and environmental goals. Notably, the circular economy constitutes a fundamental element of the European Green Deal and features among the EU Taxonomy’s six environmental objectives. Several countries, including China, Chile, and France, have taken significant strides by implementing circular economy roadmaps and enacting legislation to promote sustainable practices. This growing recognition highlights the critical role of the circular economy in shaping future policies and fostering global sustainability5.

Other notable government initiatives are the Circular Economy Action Plan (CEAP) committing billions of euros to support initiatives that drive the journey towards achieving net-zero targets within the next decade. A central element of the CEAP involves a robust eco-design strategy, which emphasizes aspects like product longevity, reusability, upgrade potential, and advocating for a “right to repair.” Additionally, the plan emphasizes the integration of recycled materials, remanufacturing practices, and the promotion of high-quality recycling methods.

In the meantime, multiple European countries have begun the process of enacting extended producer responsibility measures. These initiatives offer substantial financial incentives to companies aiming to make the shift towards circular business models.

Technological Progress

Innovation progress in areas such as chemical recycling, digital product passports, and scalable disassembly technologies is allowing for the more and more accessible industrial-scale transition to circularity3.

The growing demand for solutions that facilitate product reselling, refurbishment, and recycling especially when it comes to developing scalable material collection and take-back programs, reverse logistics, as well as automated systems for material sorting, will drive further innovations in these areas, getting the industry a step closer to full circularity3.

Sources:

1 thredUP (GlobalData Market Sizing), ThredUP 2020 Resale Report,2020.

2 Bruna Alves, Circular material use rate in the European Union 2004-2021, https://www.statista.com/statistics/1316448/circular-material-use-rate-in-european-union/, June 2023.

3 Sebastian Gatzer, Stefan Helmcke, and Daniel Roos, Playing offense on circularity can net European consumer goods companies €500 billion, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/playing-offense-on-circularity-can-net-european-consumer-goods-companies-500-billion-euros, June 2022.

4 Martin Placek, Supply chain approaches to the circular economy worldwide 2019, https://www.statista.com/statistics/1182874/circular-economy-supply-chain-approach/, April 2022.

5 Bocconi University, Ellen MacArthur Foundation, Intesa Sanpaolo (2021), The circular economy as a de-risking strategy and driver of superior risk-adjusted returns, http://www.ellenmacarthurfoundation.org/publications.

HNST Studio, the Antwerp-based label dedicated to creating jeans that embody transparency and circularity, partners with Belgian eco-design innovator Resortecs to launch new products made to be unmade—easy to disassemble for repair and recycling at the end of life.

The partnership debuts with the newly introduced Geri (for women) and Simon (for men) pants: crafted with up to 70% recycled cotton, these are HNST’s first jeans to feature an elastic waistband and drawstrings for unparalleled day-to-day comfort and flexibility.

Completely eco-designed for recycling, the jeans’ waistbands are stitched using Resortecs’ Smart Stitch™, an award-winning thread engineered to disappear under heat. This thread change at the design phase ensures that the jeans can be disassembled without manual intervention at the end of their lifecycle—allowing for their recyclable fabric to be automatically sorted out of the non-recyclable materials added to the waistband for more comfort.

“Our other jeans didn’t have elastic waistbands because they would be critical blockers for recycling. Collaborating with Resortecs allowed us to explore new possibilities to give our customers more comfort without compromising our non-negotiable commitment to circularity” stated Eva Engelen, Sustainability and Product Manager at HNST.

“We are two Belgian innovators trying to rewrite the future of fashion in a circular way,” said Cédric Vanhoeck, CEO at Resortecs. “This partnership with HNST showcases how our technology can unlock new possibilities for fashion players that want to design for recycling while keeping the creativity, functionality, and quality of their products”, he added.

The Simon and Geri pants are just the first drop of the HNST x Resortecs partnership. Both companies are committed to further integrating Resortecs’ design-for-disassembly solutions into other HNST designs, solidifying their shared vision of establishing circularity as the standard in the fashion industry. Consumers everywhere can now shop the collection at letsbehonest.eu and at select independent retailers in Europe, North America, and Japan.

Join us.

Subscribe to our newsletter.

By subscribing, I agree with having my personal data stored and processed by Resortecs so I can receive future updates and marketing offers.