In recent years, a significant transformation has been underway in the world of finance, with Environmental, Social, and Governance (ESG) considerations taking center stage. This shift is not merely ideological but stems from a growing recognition among financial decision-makers that sustainable practices are not only ethically sound but also financially lucrative. As corporations face mounting pressure to address societal challenges, a parallel movement is unfolding, propelling the circular economy into the spotlight as a lucrative investment opportunity. This change can be attributed to various factors.

1. In a shifting landscape, financial decision-makers with aspirations beyond mere monetary gains are demanding tangible actions from corporations. The prevailing sentiment acknowledges that Environmental, Social, and Governance (ESG) considerations not only serve as risk indicators but also foster enduring expansion and cultivate novel avenues of value by supporting entities that are actively addressing the current social challenges. Insights from Opimas and the Global Sustainable Investment Alliance unveil a staggering surge in ESG investments, exceeding $40 trillion in 2020 from a baseline of $23 trillion in 2016. Projections by Deutsche Bank underscore an imminent paradigm shift, suggesting that a substantial 95% of assets under management, equating to $130 trillion, will align with ESG principles by 20301.

2. Concurrently, governmental bodies, regulatory authorities, and central banks are realigning public expenditures and policy frameworks to facilitate the shift toward an all-encompassing, environmentally conscious circular economy. The configuration of investment opportunities is transforming, evolving beyond being a fad to manifest as a substantial and widespread movement1.

“Over the last 18 months, funds that focus on environmental-focused investments have outperformed almost all other forms of index, some people will call that a momentum investment. I would call that a sea change, I would call that a recognition that we have to move forward fast. Larry Fink, CEO, BlackRock 13 August 20211.

These factors have resulted in a substantial upswing in dedicated financing activities to offer investors a wider array of options to align their portfolios with sustainable and circular practices, leading to the emergence of different debt and equity instruments tailored to support circular economy initiatives.

Among these financial instruments are public equity funds (their number increasing from 2 in 2018 to 13 in 2021 including funds from the world’s largest investors BlackRock, BNP Paribas, Credit Suisse, and Goldman Sachs), corporate and sovereign bonds, venture capital, private equity (tenfold increase in the number of private market funds from 2016 to H1 2020), and private debt. Financial institutions have also actively participated in driving circular economy initiatives through bank lending, project finance, and insurance solutions2.

One example of the financial sector’s commitment to sustainable and circular practice is the exceptional growth in assets under management (AUM) in public equity funds centered around the circular economy. Between December 2019 and the first half of 2021, AUM skyrocketed from $0.3 billion to an astounding figure exceeding $9.5 billion at the end of November 2021, demonstrating a 28-fold in less than 2 years2.

Additionally, between December 2019 and December 2021, the issuance of corporate and sovereign bonds centered around the circular economy witnessed an impressive 5-fold increase. Over the past three years, a minimum of 40 such bonds were issued, highlighting the growing interest and commitment towards financing circular economy initiatives2.

Last, but not least, index providers are diversifying their offerings to encompass the circular economy domain, unveiling a host of new specialized products. Here are a few examples:

— Solactive has taken the lead by introducing an index with a focus on the sharing economy.

— Morgan Stanley Capital International (MSCI) has entered the scene with its index that highlights the circular economy and renewable energy.

— ECPI group has launched the Circular Economy Equity Leader Index, designed to capture companies excelling in various circular economy aspects3.

This remarkable financial mobilization highlights the confidence of stakeholders that the circular economy is not just an ethical choice but also an increasingly lucrative investment opportunity.

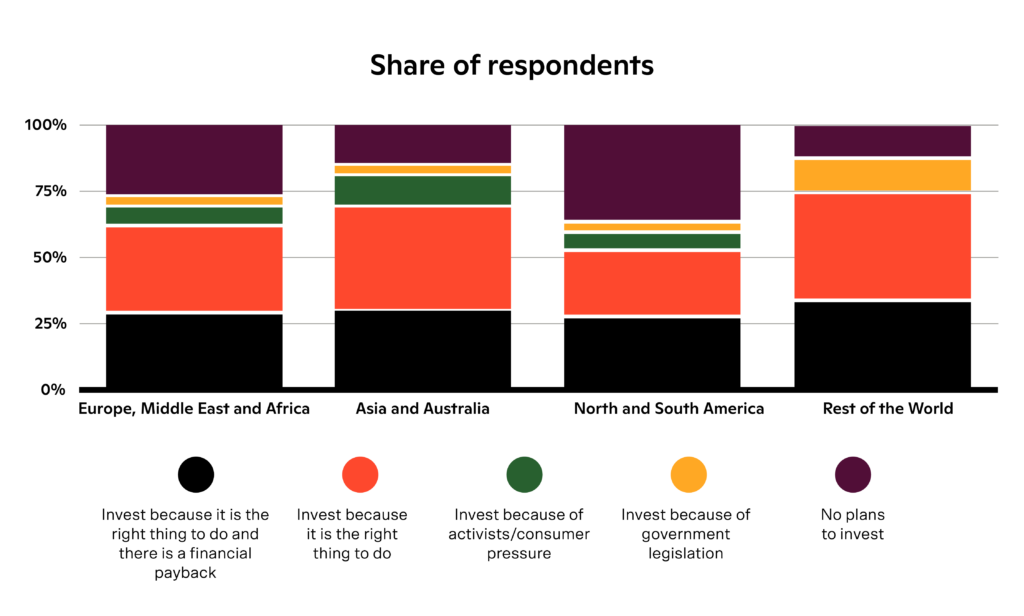

That confidence is also supported on the individual level. Naturally, many investors choose to invest in the circular economy because it is the right thing to do. However, it becomes obvious that increasingly, investors recognize the financial potential of such investments. Roughly one-third of investments in the circular economy in Europe, the Middle East, Africa, Asia, Australia, and North and South America are recognising the increasing returns4.

The rising confidence from financial institutions and individuals is not without support. A recent analysis by Bocconi University of 200+ European publicly listed companies supports the idea that circularity is the new winning strategy for investors looking to de-risk their investments and deliver superior risk-adjusted returns2.

The circular economy as a strategy to de-risk debt

In recent years, it has become increasingly clear that factors such as climate change, other climate-related crises, rising geopolitical tensions, and other societal challenges pose significant investment risks, and the financial sector is recognizing that. All actors in the financial system should work towards avoiding a climate-driven ‘Minsky moment’.

The recent analysis highlights that the more circular a company is the lower the risk of defaulting2. A 0.1 increase in Circularity Score (scoring developed by Bocconi University and Intesa Sanpaolo) is responsible for the reduction in the probability of default on debt by 8.63% (one-year timeline) and by 4.93% (five-year timeline)2.

The circular economy as a strategy for superior risk-adjusted returns

The same analysis concludes that the more circular a company is, the higher the risk-adjusted returns it generates on investment2.

Public equity funds with circular economy as a sole or partial investment focus on average performed 5.0 percentage points better than their Morningstar category benchmarks in the first half of 20202.

Potential drivers of these circular economy benefits include:

— a focus on design and business model innovation and diversification

— achieving greater resource decoupling

— anticipation of stricter regulation

— changing customer preferences

— resource scarcity

As the world grapples with pressing environmental and social challenges, the circular economy emerges not only as a solution but also as a lucrative investment opportunity. By embracing sustainable practices and innovative business models, investors can not only contribute to a more resilient and equitable future but also reap substantial financial rewards. In an era where the intersection of profitability and sustainability is increasingly recognized, the circular economy stands poised to redefine the landscape of finance for years to come.

Sources:

1 Mark Carney, Unlocking the Value of the Circular Economy, https://ellenmacarthurfoundation.org/articles/unlocking-the-value-of-the-circular-economy, August 2021.

2 Bocconi University, Ellen MacArthur Foundation, Intesa Sanpaolo (2021), The circular economy as a de-risking strategy and driver of superior risk-adjusted returns, http://www.ellenmacarthurfoundation.org/publications.

3 Mara Steinbrenner, Financing Circular Economy, https://neosfer.de/en/financing-circular-economy/, September 2022.

4 Martin Placek, Circular economy investment motives and decisions worldwide in 2019, by

region, https://www.statista.com/statistics/1182841/circular-economy-investment-decision-region/, April 2022.

Discover how Resortecs closes the loop stitch by stitch.

Please Fill the fields, we will contact you

as soon as possible.

OTHER ARTICLES

Join us.

Subscribe to our newsletter.

By subscribing, I agree with having my personal data stored and processed by Resortecs so I can receive future updates and marketing offers.